A- | A | A+ हिंदी

A- | A | A+ हिंदी

Skip to main content

A- | A | A+ हिंदी

A- | A | A+ हिंदी

Skip to main content

The FMCG sector in India expanded due to consumer-driven growth and higher product prices, especially for essential goods. FMCG sector provides employment to around 3 million people accounting for approximately 5% of the total factory employment in India. FMCG sales in the country was expected to grow 7-9% by revenues in 2022-23. The key growth drivers for the sector include favourable Government initiatives & policies, a growing rural market and youth population, new branded products, and growth of e-commerce platforms. Resilience needs to be the key factor in the manufacturing process, daily operations, retail and logistic channels, consumer insights and communication that will help FMCG companies to withstand the test of time and create more value for consumers in the long run.

Fast-moving consumer goods (FMCG) sector is India’s fourth-largest sector and has been expanding at a healthy rate over the years because of rising disposable income, a rising youth population, and rising brand awareness among consumers. With household and personal care accounting for 50% of FMCG sales in India, the industry is an important contributor to India’s GDP.

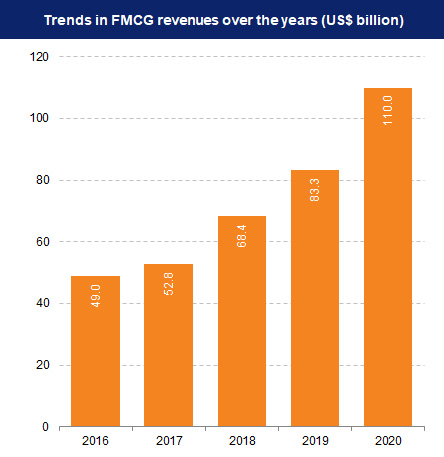

FMCG market reached US$ 56.8 billion as of December 2022. Total revenue of FMCG market is expected to grow at a CAGR of 27.9% through 2021-27, reaching nearly US$ 615.87 billion. In 2022, urban segment contributed 65% whereas rural India contributed more than 35% to the overall annual FMCG sales. Good harvest, government spending expected to aid rural demand recovery in FY24. The sector had grown 8.5% in revenues and 2.5% in volumes last fiscal year. In the January-June period of 2022, the sector witnessed value growth of about 8.4% on account of price hikes due to inflationary pressures. In Q2, 2022, the FMCG sector clocked a value growth of 10.9% Y-o-Y higher than the 6% Y-o-Y value growth seen in Q1.

Indian food processing market size reached US$ 307.2 billion in 2022 and is expected to reach US$ 547.3 billion by 2028, exhibiting a growth rate (CAGR) of 9.5% during 2023-28.

Digital advertising will grow at 14.75% CAGR to reach Rs. 35,809 crore (US$ 4.3 billion) by 2023, with FMCG industry being the biggest contributor at 42% share of the total digital spend.

India includes 780 million internet users, where an average Indian person spends around 7.3 hours per day on their smartphone, one of the highest in the world. Number of active internet users in India will increase to 900 million by 2025 from 759 million in 2022. In 2021, India’s consumer spending was US$ 1,891.90 billion. Indian villages, which contribute more than 35% to overall annual FMCG sales, are crucial for overall revival of the sector. E-commerce now accounts for 17% of the overall FMCG consumption among evolved buyers, who are affluent and make average spends of about Rs. 5,620 (US$ 68).

Rural consumption has increased, led by a combination of increasing income and higher aspiration levels. There is an increased demand for branded products in rural India. On the other hand, with the share of the unorganised market in the FMCG sector falling, the organised sector growth is expected to rise with an increased level of brand consciousness, augmented by the growth in modern retail. Another major factor propelling the demand for food services in India is the growing youth population, primarily in urban regions. India has a large base of young consumers who form most of the workforce, and due to time constraints, barely get time for cooking. Online portals are expected to play a key role for companies trying to enter the hinterlands. The Internet has contributed in a big way, facilitating a cheaper and more convenient mode to increase a company’s reach. The number of internet users in India is likely to reach 1 billion by 2025. It is estimated that 40% of all FMCG consumption in India will be made online by 2020. E-commerce share of total FMCG sales is expected to increase by 11% by 2030. It is estimated that India will gain US$ 15 billion a year by implementing GST. GST and demonetisation are expected to drive demand, both in the rural and urban areas and economic growth in a structured manner in the long term and improved the performance of companies within the sector.