A- | A | A+ हिंदी

A- | A | A+ हिंदी

Skip to main content

A- | A | A+ हिंदी

A- | A | A+ हिंदी

Skip to main content

As per the Reserve Bank of India (RBI), India’s banking sector is sufficiently capitalised and well-regulated. The financial and economic conditions in the country are far superior to any other country in the world. Credit, market and liquidity risk studies suggest that Indian banks are generally resilient and have withstood the global downturn well.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years India has also focused on increasing its banking sector reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. Schemes like these coupled with major banking sector reforms like digital payments, neo-banking, a rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Indian Fintech industry is estimated to be at US$ 150 billion by 2025. India has the 3rd largest FinTech ecosystem globally. India is one of the fastest-growing Fintech markets in the world. There are currently more than 2,000 DPIIT-recognized Financial Technology (FinTech) businesses in India, and this number is rapidly increasing.

The digital payments system in India has evolved the most among 25 countries with India’s Immediate Payment Service (IMPS) being the only system at level five in the Faster Payments Innovation Index (FPII).* India’s Unified Payments Interface (UPI) has also revolutionized real-time payments and strived to increase its global reach in recent years.

The Indian banking system consists of 12 public sector banks, 22 private sector banks, 46 foreign banks, 43 regional rural banks, 1485 urban cooperative banks and 96,000 rural cooperative banks in addition to cooperative credit institutions. As of March 2023, the total number of ATMs in India reached 14,74,548. Moreover, there are 1,21,894 on-site ATMs and Cash Recycling Machines (CRMs) and 96,243 off-site ATMs and CRMs.

Bank assets across sectors increased significantly since 2020. In 2022-23, total assets in the public and private banking sectors were US$ 1,553.57 billion and US$ 901.3 billion, respectively.

In 2022-23, assets of public sector banks accounted for 59.24% of the total banking assets (including public, private sector and foreign banks).

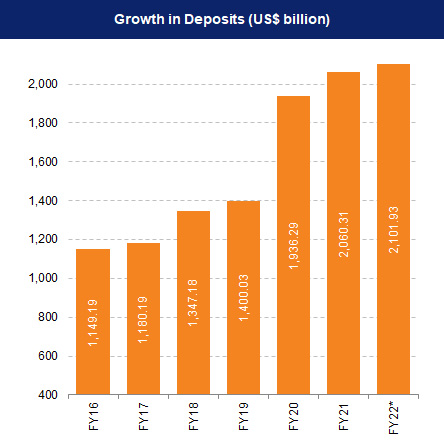

According to RBI’s Scheduled Banks’ Statement, deposits of all scheduled banks collectively surged by a whopping Rs.1.98 lakh crore (US$ 24.32 billion) as on May 5, 2023, at a growth rate of 10.2%.

According to the BCG Banking Sector Roundup Report of 9M FY23, credit growth is expected to hit 18.1% in 2022-23 which will be a double-digit growth in eight years. As of November 4, 2022 bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion).

Non-food bank credit registered a growth of 17.6% in November 2022 as compared with 7.1% a year ago on the back of robust credit demand from the segments such as services, industry, personal, and agriculture and allied activities, according to RBI’s statement on Sectoral Deployment of Bank Credit.

Key investments and developments in India’s banking industry include:

Enhanced spending on infrastructure, speedy implementation of projects and continuation of reforms are expected to provide further impetus to growth in the banking sector. All these factors suggest that India’s banking sector is poised for robust growth as rapidly growing businesses will turn to banks for their credit needs. The advancement in technology has brought mobile and internet banking services to the fore. The banking sector is laying greater emphasis on providing improved services to their clients and upgrading their technology infrastructure to enhance customer’s overall experience as well as give banks a competitive edge.

In recent years India has experienced a rise in fintech and microfinancing. India’s digital lending stood at US$ 75 billion in FY18 and is estimated to reach US$ 1 trillion by FY23 driven by the five-fold increase in digital disbursements. The Indian fintech market has attracted US$ 29 billion in funding over 2,084 deals so far (January 2017-July 2022), accounting for 14% of global funding and ranking second in terms of deal volume. By 2025, India's fintech market is expected to reach Rs. 6.2 trillion (US$ 83.48 billion).